America has 10 Million New Homeowners

Despite constrained affordability, homeownership is rising

Welcome back to Home Economics, a data-driven newsletter about the housing market. Today we are reporting a rare positive story about housing, and one we think has been overlooked elsewhere. Paying subscribers can find the data behind the charts in the usual spot, and can book a one-on-one call with me to discuss these results. If you like this post, let us know on Twitter, leave a comment, or hit ‘reply’ to this email.

SPEED READ

One of the frequent topics middle-aged male tennis players (like myself) like to debate is why Novak Djokovic, despite a record 24 Grand Slam titles (25 if he wins the Australian Open this weekend), fails to inspire the same adulation as Roger Federer (who racked up a mere 20 slams before his retirement in 2022).

Some people think it’s Djokovic’s mercurial personality. Others think it’s a bias against his nationality (Serbian). Maybe. For me, it’s that Djokovic’s tennis is robotic. There is no elan, no panache. Above all, Djokovic lacks Federer’s creativity.

My favorite arrow in Federer’s quiver is the fake out. It’s a cheeky shot he uses for short balls that he has time to play with. Federer runs toward the ball with his head tilted crosscourt, as if he will hit it there. His opponent invariably scurries in that direction. And then—without even looking at the ball—Federer tucks it gently down the line, away from his opponent. They don’t stand a chance. Sometimes his opponents can’t help but chuckle quietly to themselves as they retreat to their corner. It’s that good a shot.

I’ve been thinking about the fake out in the context of a prominent narrative that’s taken hold lately in newspapers and on social media: that Americans are increasingly turning away from buying homes in favor of renting them, and that the richest are embracing renting most enthusiastically.

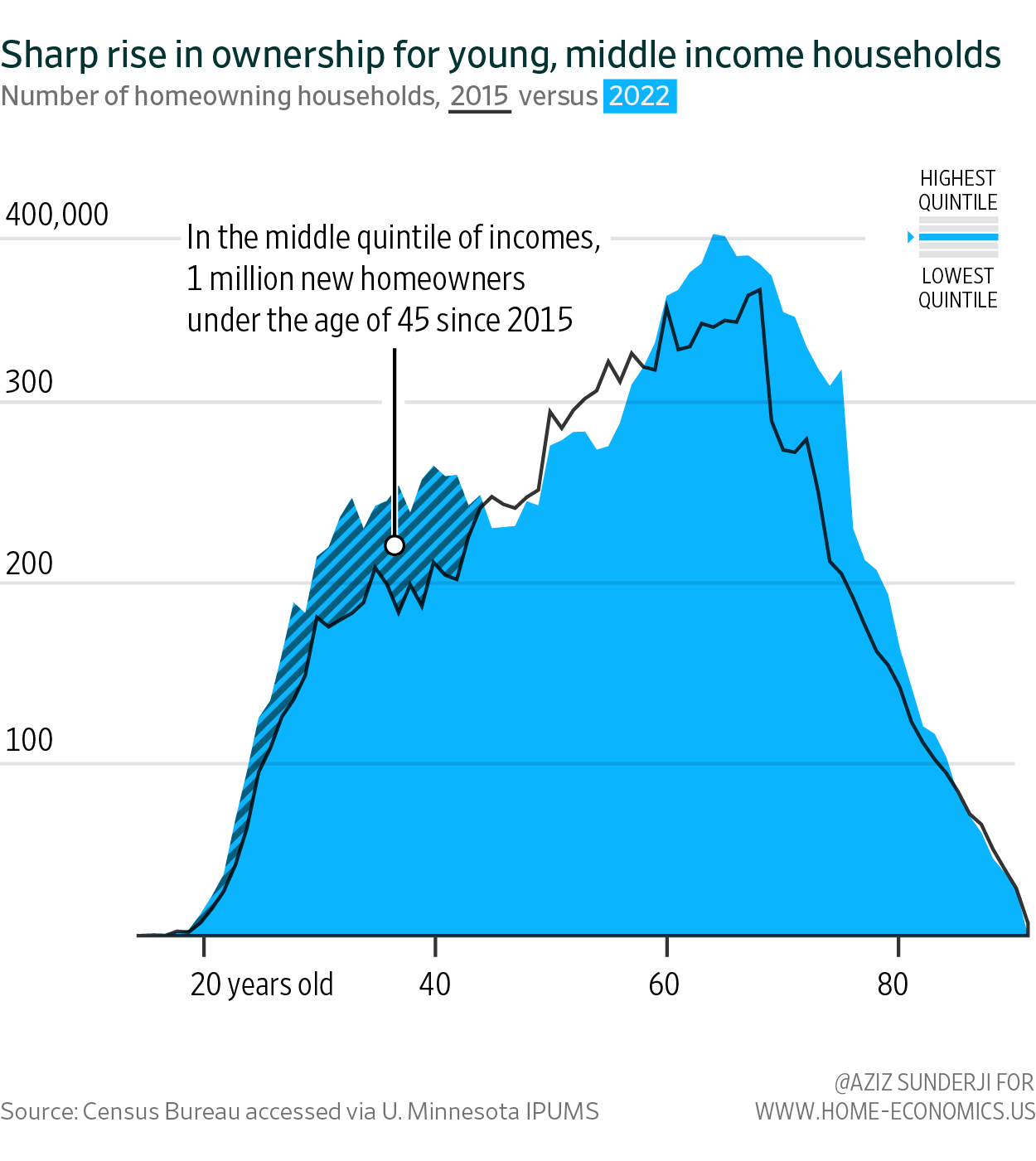

Our analysis of Census Bureau data shows the exact opposite: homeownership in America is rising. Since 2015, when the post-GFC recovery started, the number of home-owning households1 has grown by 10 million, driven in part by a sharp rise in ownership among middle-income households headed by people under the age of 45.

That’s not to say all is well with housing in this country. Home affordability is stretched. The median household is spending more on housing than ever before. A growing number of them are “housing-burdened”, spending more than 30% of their gross income on housing costs.

But even as housing costs and high mortgage rates suggest ownership should be declining, that’s just not true—like Federer’s trick shot, things are moving in a surprising direction. It’s hard to buy a home these days, but more of us are doing it anyway.

The rest of this article is for paying subscribers only, and addresses the following questions:

What’s driving rising ownership?

How can we reconcile rising ownership with stretched affordability?

Will homeownership continue to rise?

Keep reading with a 7-day free trial

Subscribe to Home Economics to keep reading this post and get 7 days of free access to the full post archives.