Welcome back to Home Economics, a newsletter about the American housing market. This is The Week in Review, my weekly recap of macro and real estate news. Articles with a ◎ are free. Those with a ◉ have free previews but are only accessible in full for paying subscribers. Upgrade your subscription here:

The article I published earlier this week, What Determines Home Prices (◎), was polarizing! The responses ranged from “this is your best piece yet!” to “I am not convinced” to “even if the content and data is great, using a sperm icon in the graph was an awful choice”.

Because of the density of the “sperm icons” in the chart showing median home prices vs median incomes by county, I could only label a handful of them in the article, so I created an interactive version; it allows you select a county and see how its income and home prices have evolved since 2014. It’s for paying subscribers only—screenshot here, and the link is after the paywall at the bottom of this note.

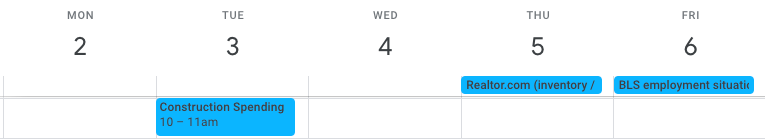

The main piece of economic data next week is the employment report at the end of the week. This report is the single most influential piece of data for market movements, and it should be especially eventful as the Fed transitions from raising rates to cutting them. Indeed, it was a very weak reading in the employment report last month that ratified the lurch downward in bond yields after Fed Chair Powell signaled forthcoming rate cuts.

Subscribers can download the housing economic data calendar here ◉.

News: The Case-Shiller index showed decelerating home price gains

Views: Normal home price valuations will be restored via years of slow gains

As Thomas Ryan at Capital Economics notes:

“the 0.2% m/m rise in the seasonally adjusted national Case-Shiller index was the smallest increase since December 2023 and much smaller than the 0.7% m/m gain last year, causing house price inflation to fall sharply to 5.4%, from 5.9%. This is a marked slowdown from earlier in the year, when annual house price growth peaked at 6.6%.”

The Case-Shiller trend is the same as what Zillow has been showing for months—a gradual deceleration in the pace of price gains. I think there is further weakness to come.

For one, incomes are the best predictor of home prices, and they are softening. Second, home prices are now very high versus incomes and rents. A period of consolidation is in order.

Further reading:

Why Zillow is a better index to follow than Case-Shiller, here ◉

Rents are rising rapidly in the biggest cities, like New York, here ◉

Incomes are correlated with prices, here

News: ApartmentList rents cooled

Views: Rents declines are concentrated in sunbelt markets

As the team at ApartmentList writes:

“Our model captured an average rent decrease of -0.1% in August…On a year-over-year basis, national rent growth remains in negative territory at -0.7 percent. Year-over-year rent growth…dipped below zero back in June 2023 and has stayed there for fifteen consecutive months. After prices skyrocketed in 2021 and 2022, the pendulum has since swung back as price growth has been kept in check by sluggish demand colliding with a robust supply of new inventory hitting the market.”

Rent drops were particularly pronounced in sunbelt cities. Many have pointed out the correlation between permits and rent declines. Maybe! But do other metrics—like incomes, jobs, and population—also explain this softness?

The US Open. This is a year of massive upsets. Carlos Alcaraz lost to Botic van de Zandschulp—“a 28-year-old from the Netherlands who seriously contemplated retirement a few months ago”. Defending champion Novak Djokovic lost to 28th-seeded Alexei Popyrin of Australia. This will be the first year since 2002 that none of the majors were captured by the “big 3” (Federer, Nadal, Djokovic)—and, for a middle-aged man like me, that fact is bittersweet. I will miss the big 3, but am excited about the next generation of players. If you don’t have YouTube TV, or if you live outside the US, you can stream the tournament for free with a VPN (like this one) on Australia’s Channel 9.

Have a great weekend,

Keep reading with a 7-day free trial

Subscribe to Home Economics to keep reading this post and get 7 days of free access to the full post archives.