An 80-year boom

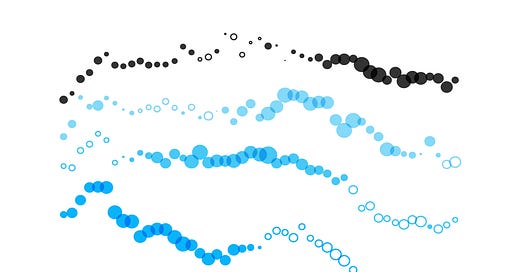

In 1944, as World War II drew to a close, President Franklin D. Roosevelt signed the Servicemen's Readjustment Act, better known as the GI Bill. Homeownership had been rising slowly at the beginning of the 20th century. The GI Bill was an inflection point. It gave returning servicemen low-interest loans with no downpayment, backed by insurance from the newly created Federal Housing Administration (FHA) and the Veterans Administration (VA).

Between the end of the war and 1950, the number of American homeowners leapt by almost 9 million. That was more than the combined increase in the four decades prior to the war.

We never looked back. Since 1940, the country has gained this same amount—roughly 9 million new homeowning households—every 10 years.

The pace of homeownership growth has held steady through violent economic crises—the severe recession in the 1970’s, and the Great Financial Crisis, for example—not to mention a handful of wars and social upheavals. Maybe most surprisingly, homeownership has continued to climb despite widespread and long-running concerns about home affordability.

But, 80 years after the homeowner explosion began, things may be about to change.

People—especially young people—are not striking out to start their own households as much as they did in the past. More are living with their parents, or with friends—and fewer are buying their own homes.

Even more importantly, Americans are at the vanguard of a global trend towards declining fertility. Last year, for the first time, the Census Bureau forecast the American population starting to shrink. They anticipate this happening in just over 50 years. Were it not for immigration, the population would start to shrink in just over 10 years.

This raises an important question:

Can America continue to grow homeownership in the decades to come?

Population growth—and more recently, the aging of the population—has long provided a tailwind for realtors, builders, investors, and other participants in the housing market. It’s transformed real estate into the biggest industry in America. Can this momentum continue?

Today's article is a deep-dive into the future of homeownership, and it’s only for paying subscribers. I draw on academic research, analyze a dozen data sets, and grapple with the competing trends to answer some of the biggest questions for those in the housing industry:

What determines homeowner growth?

What does an aging and more slowly-growing population mean for homeownership?

Most crucially for those in the industry, has the long-running housing boom peaked?

I had expected this to be an article forecasting a peak in homeowner growth sometime around 2030. In fact, my research and analysis led me to a very different conclusion—one that suggests we’re at a critical juncture for those in the real estate industry, and raises more big questions about the years ahead.

Keep reading with a 7-day free trial

Subscribe to Home Economics to keep reading this post and get 7 days of free access to the full post archives.