One Home Price Index to Rule them All?

Case-Shiller, FHFA, Zillow—the list goes on. But one is better than the rest.

This article will be useful for anyone who needs to track home prices or communicate home price data to others. I stick to the basics here. For those who want to get into the weeds, I provide links to conversations with ChatGPT in which I ask the robot to explain complicated things to me in plain English. If you only have 30 seconds to read this, skip straight to the final figure (behind the paywall).

The most important number in real estate

No single data point in real estate is more closely watched than the Case-Shiller index. It tracks the prices of single-family homes bought and sold in a given month.

The focus on Case-Shiller and other home price indexes is deserved. We can easily observe market prices in real time on the MLS and listing apps like Zillow, but only indexes allow us to make observations about the market as a whole, and to make comparisons over time and across markets.

Maybe most importantly, indexes tell us which regime we are in: are prices rising or falling? This is crucial information. For example: a prospective homeseller perceiving a change from rising to falling prices will want to reduce their asking price, making a faster sale to avoid selling at an even lower price in the future.

But Case-Shiller and other indexes are based on transactions that happened months earlier. As a result, they are often criticized as a poor proxy for current market conditions. Many think the information is degraded at best, and maybe even entirely useless. But this criticism is overcooked.

Yes, index data is delayed. But home prices exhibit momentum. That is, they tend to move in the same direction for long stretches of time. If prices went up last month, it's much more likely than not that they are still rising today.

Still, the criticism has merit. For those participating in transactions today, the freshest data is much more useful than stale data from months ago.

Those in the business of buying and selling homes should therefore be laser-focused on the most timely data. In particular, what matters most is seeing the turning points as early as possible—it's these turning points that necessitate a change in our approach to the market.

One index signals turning points earlier than others

There are half a dozen widely followed home price indexes. Does it matter which you use?

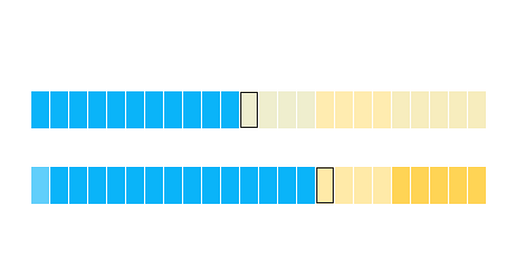

At first glance, the chart below suggests the major indexes all say the same thing. For simplicity, I have only included 3 major indexes—Case-Shiller, FHFA, and Zillow—but adding more wouldn't change the picture: they all move together.

Since the indexes move together, maybe it doesn't matter which you follow? That couldn't be further from the truth.

In fact, there is one index that is far superior to the others: it reliably signals turning points in the market 1-2 months before others.

In this note for paying subscribers, I dig into:

The tradeoffs of simplifying the market into a single number

How to communicate index data to non-experts

Why one index is far better than all the others

By subscribing, you'll get access to this article, our customizable Buy or Rent tool, and the full Archive of Home Economics articles—where I've written about everything from Where mortgage rates are going to Why buying makes more sense than renting.

Keep reading with a 7-day free trial

Subscribe to Home Economics to keep reading this post and get 7 days of free access to the full post archives.