Welcome back to Home Economics—research about America’s housing market.

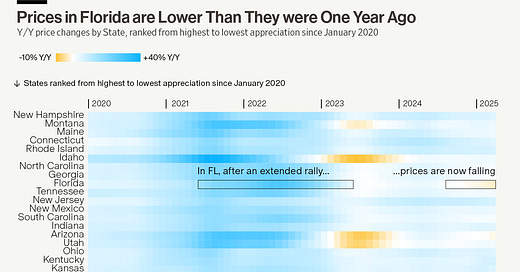

Home prices in Florida are now 3% below the peak they reached in May 2024.

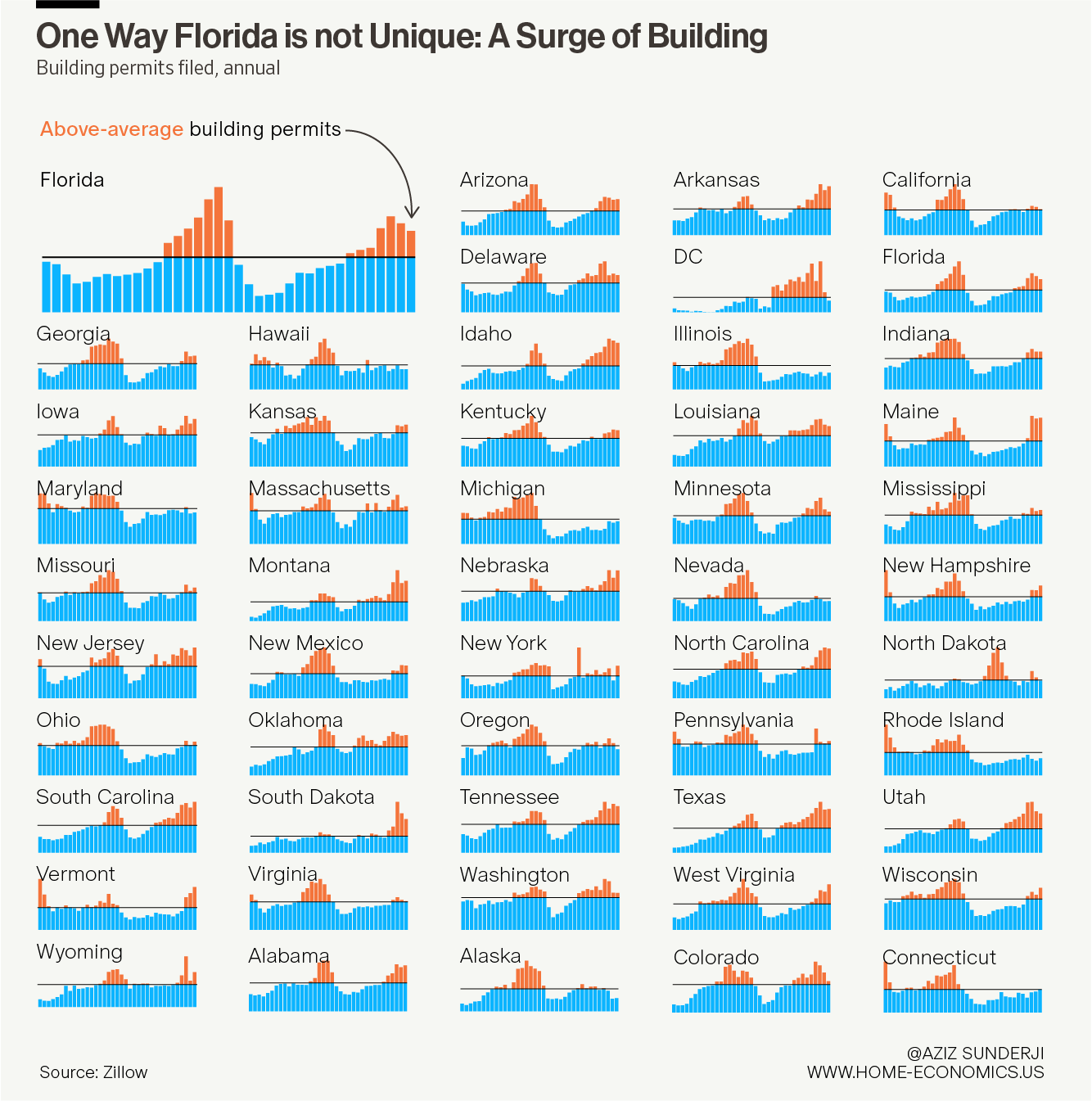

This is in itself is not particularly meaningful. About half of the states are now below their recent peaks. And among these states, at 3% below the peak, Florida has fallen by less than many. Arizona, for example, is 7% below its peak. Washington DC is more than 9% below its peak. Based on percentage changes in prices since 2020, Florida is still in the top 10.

What does make Florida uniquely worrying is that—while most states that have fallen below their peaks are now recovering, with prices rising y/y—prices in Florida continue to decline and by much more than everywhere else. In only a handful of states are home prices falling y/y. In Florida they’re falling at the fastest rate (-3%).

What happens in Florida stays in Florida?

We might now reasonably begin to wonder if what's happening in Florida will stay in Florida or if the state's price action is a canary in a coal mine, presaging falling prices in the rest of the country.

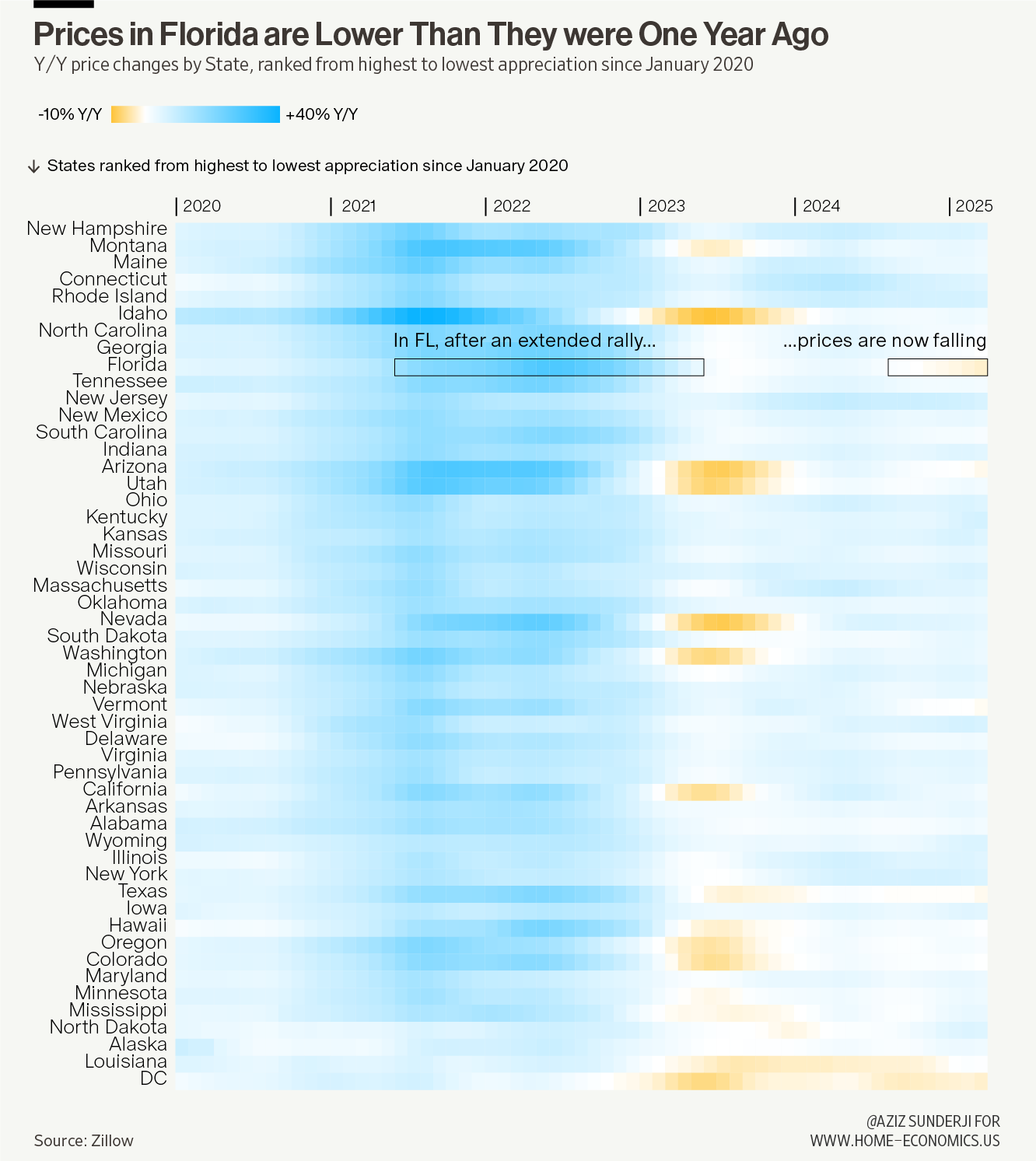

There are certainly good reasons to worry. Falling prices in Florida are more meaningful than similar price action elsewhere. For one, Florida is amongst the most populous states, of course. But more importantly, national home prices track those in Florida with more fidelity than they do any other state. Florida’s housing market is high beta, but it is still—at least historically—the least idiosyncratic of all states.

Our sense is that the factors responsible for the downturn in Florida are sufficiently idiosyncratic that it's more likely than not that the price pressures we see there are not a sign of what's to come for the rest of the country. But it’s a close call.

Climate change and insurance premia

For one, the state is grappling with the accelerating impacts of climate change, including more frequent and severe hurricanes, which have led to a surge in insurance premiums—doubling in some areas over the past three years.

These climate-led pressures are more intense in Florida than they are in most other states. Between 2019 and 2024, premiums in Florida surged by as much as 400% in certain regions, driven by escalating climate-related risks, a series of devastating hurricanes, and a wave of insurer withdrawals from the state market.

This contrasts with the national average, which saw premiums rise by about 20% over the two years prior to 2024, according to NAR. In 2024, Florida's average homeowners insurance premium reached approximately $11,000 annually, nearly five times the national average of $2,329 for $300,000 in dwelling coverage.

Compounding these challenges are stringent building safety regulations enacted after the 2021 collapse of the Champlain Towers South in Surfside, which claimed 98 lives. The 2022 legislation mandates structural inspections and fully funded reserves for major repairs in older condominium buildings. While aimed at preventing future disasters, these requirements have resulted in substantial special assessments for condo owners—sometimes exceeding $100,000 per unit—forcing many to sell at significant losses or face foreclosure. Although recent legislative amendments have introduced some flexibility, such as extended deadlines and alternative funding options, many Florida condo owners are financially strained.

New and existing home supply

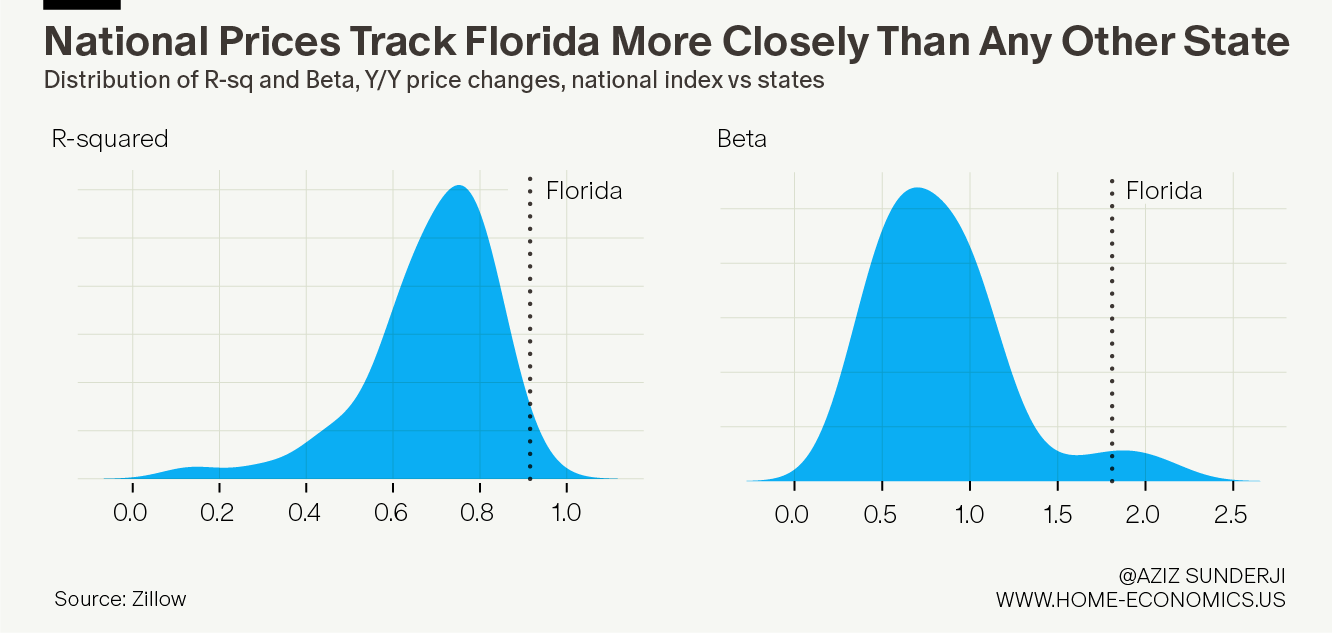

Both the supply of existing homes and newly built homes are rising rapidly in Florida. But while the increase in active listings of existing homes is somewhat endogenous—driven in part by weakening demand that both pushes inventory up and prices down—the surge in newly built supply is an independent negative pressure on home prices.

The chart below shows the average of annual building permits filed in each state since 1988 (we are using permits as a proxy for actual construction). The portions of supply above this average are colored in red. Florida is by no means the only state to be experiencing above average new home supply. But it is among those that have seen the largest surge in additional new supply.

Snowbirds

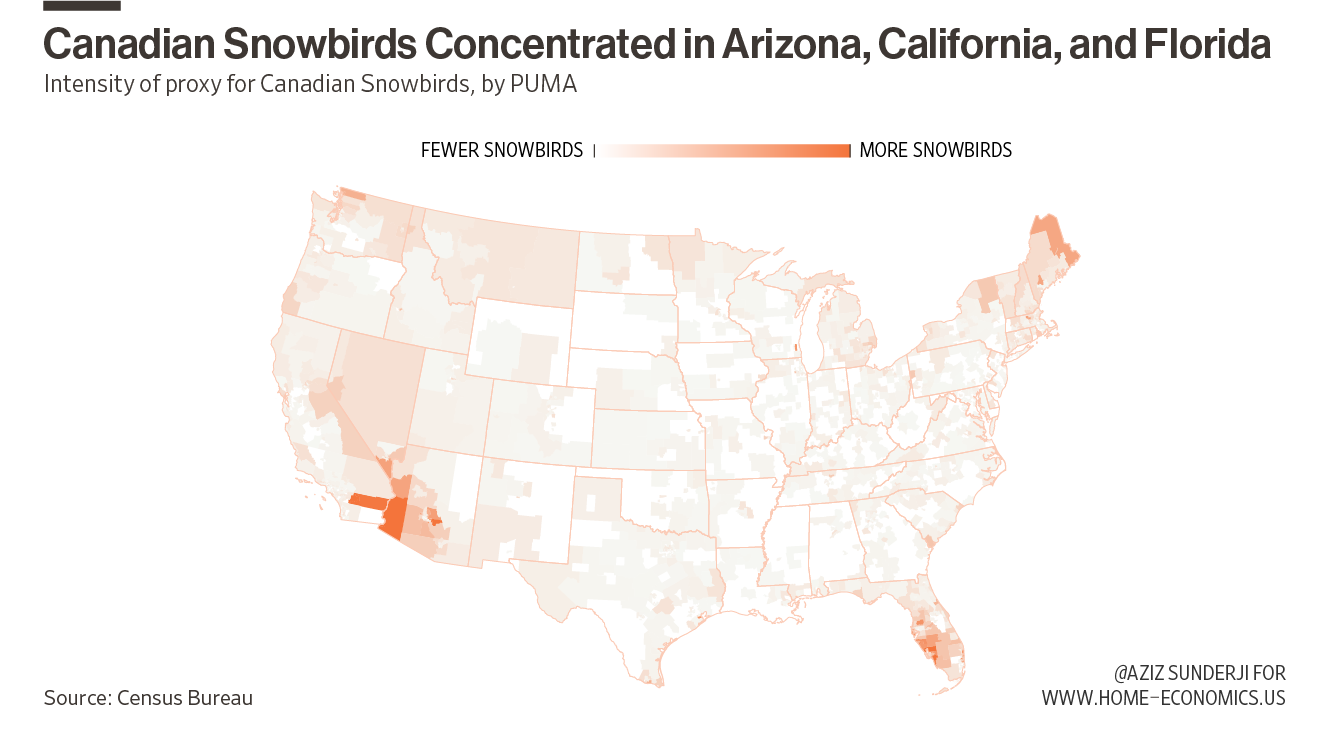

The combination of a stronger U.S. dollar, at least versus the Canadian dollar and over the longer run, rising maintenance costs, and the recent political tension has led many Canadian retirees to consider selling their seasonal properties in the U.S. (we wrote about this last week here). Of all homes owned by Canadian Snowbirds in the US, our calculations suggest 27% are in Florida, followed by 11% in each of California and Arizona. This is another factor that is not limited to Florida, but puts it in a cohort of a limited number of other states.

Florida is not a leading indicator

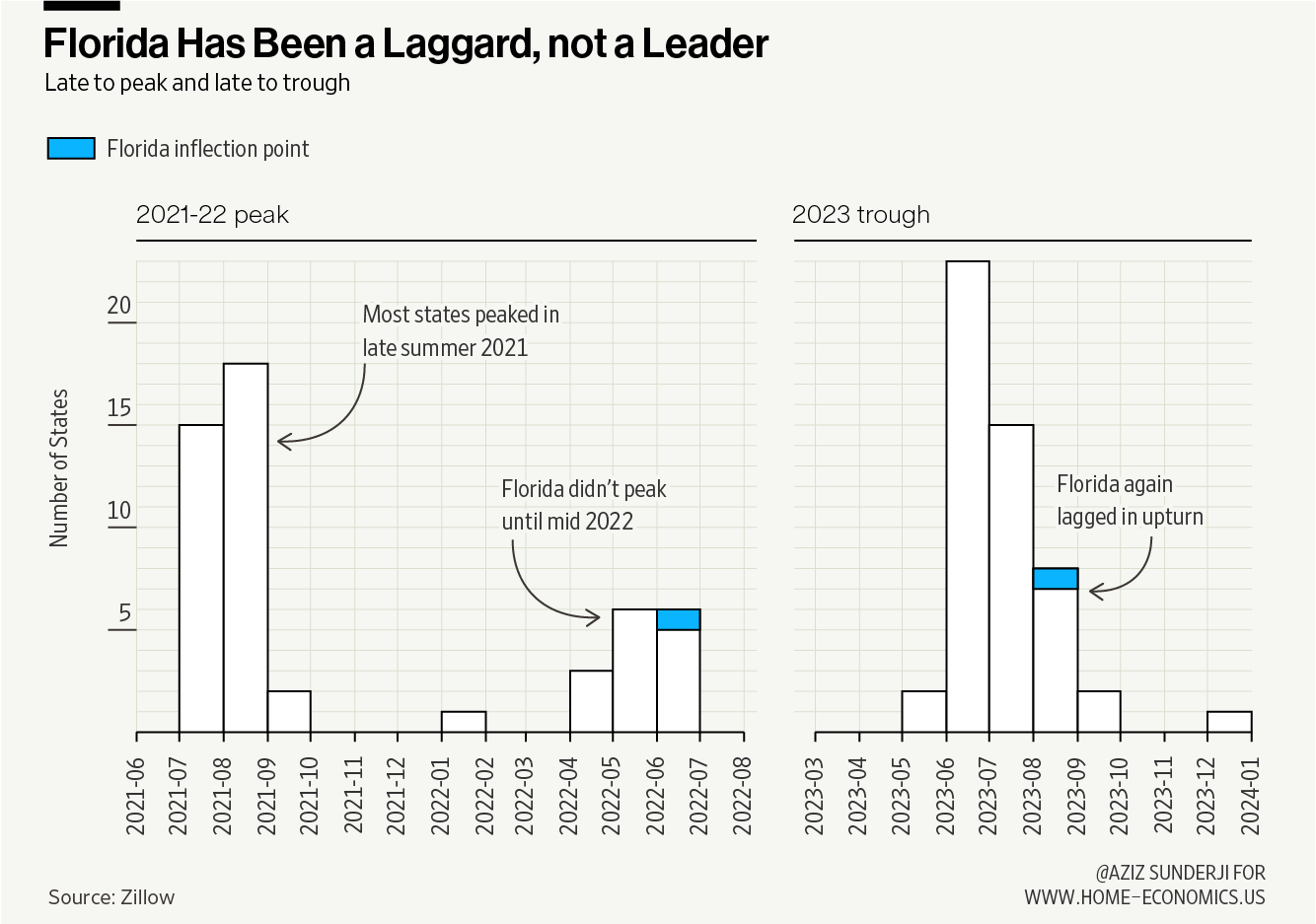

Another important reason we think that what's happening in Florida is not indicative of what will happen in the rest of the country is that there's very limited evidence that Florida has historically led the country in price moves.

As shown above, Florida home prices are highly correlated with national home prices, and have very high beta (home prices in FL rise a lot in upswings and fall a lot in downturns). But our analysis of pairwise correlations across all states over the last 25 years shows no evidence that Florida consistently leads the rest of the country.

And in the most recent cycle, where prices peaked in 2021-22 and troughed in 2023, Florida was a laggard, not a leader.

Greenspan’s mistake

For those of us old enough to have been working during the Great Financial Crisis, it's hard to forget Alan Greenspan’s catastrophically incorrect view—offered in 2004—about the prospects of a nationwide housing downturn:

“While local economies may experience significant price imbalances, a national severe price distortion seems most unlikely in the United States, given its size and diversity.”

But Greenspan's words are a lot more true today than they were 20 years ago. Especially since the pandemic, idiosyncratic factors like local insurance rates, new housing supply, regulation, and migration have increasingly shaped home prices. And these are all factors that have applied differentially across states. Real estate is again local—or at least, more local than it has been this century.

To be fair, we see some of the factors affecting Florida—rising new supply, higher insurance costs, and weakening demand—in other states, too. But to us, the balance of evidence suggests that Florida's downturn is unlikely to be a harbinger of things to come elsewhere across the country.

You are pretty accurate in your analysis. I used to own property in Florida which I bought at less then half what it had been a couple of years earlier. 2012 versus 2008. Actually way less than half. In Florida price changes of 5 of so percent are nothing. Florida has had major cycles since the boom of the 1920's. Insurance costs and prospect of not getting ANY coverage are creating and will continue to create a major downcycle in prices there. It is and will be a timers market in that location.

Great analysis as usual!

"These climate-led pressures are more intense in Florida than they are in most other states."

It seems like Florida & much of the warmer coastal SE Gulf area has attracted so many who feel "Live Free Today!" aka no taxes & regulations. While they act like The Future!? is not our problem...

This mentality makes sense since who would pay so much $$$ for millions of housing units of built on top of sinking swampland. These swamplands are being taken back by Mother Nature via Climate Change & the annual category 4-5 & now cat. 6 hurricanes. While the destroyed housing is rebuilt via Disaster Socialism aka FEMA - the rest of the country pays 10s & even 100s of $Bs...every...single...year. This is not sustainable over the coming decades & genertions....HOI industry is letting us know this NOW! Not in the future...