Deporting Undocumented Workers Will Make Housing More Expensive

The effect will be most pronounced in Texas and California

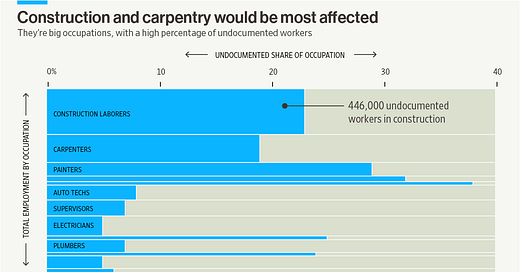

If President Trump makes good on his promise to deport millions of undocumented workers, homes will become substantially more expensive.

Trump's mass deportation plan faces hurdles. Logistics alone present challenges—not least, navigating complex diplomatic relationships with receiving countries.

But make no mistake: enforcement is ramping up dramaticall…

Keep reading with a 7-day free trial

Subscribe to Home Economics to keep reading this post and get 7 days of free access to the full post archives.